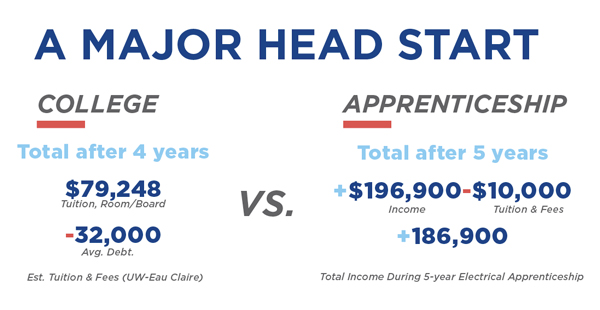

Also consider that unlike four-year college students, apprentices are paid while they’re in school and progressively earn more each year of their three- to five-year programs. Apprentices graduate with essentially no education-related debt and many are able to secure home ownership and build cash reserves while in school. Many apprentices also progress into management positions and many even start their own companies.

Certainly, it’s not all about the money, but career passion and payback should be considered to avoid the one-pathway mentality. Securing a college degree without a mountain of debt is becoming impossible for many individuals. As more parents and students begin to question the wisdom of the college investment and look more openly at alternatives like apprenticeship, they can be confident they are making a smart choice.

Learn more about apprenticeship here.

Many parents and students, meanwhile, are surprised to hear that the median starting salary for graduating apprentices in Wisconsin is more than $77,000, with several construction trades even higher,

Many parents and students, meanwhile, are surprised to hear that the median starting salary for graduating apprentices in Wisconsin is more than $77,000, with several construction trades even higher,